Together With

Read Time: 5.9 Minutes

Hi Operators ⚙️

I’ve jumped on 120 calls with subscribers this week to talk about the Q2 roadmap for The Bottleneck. Wanna chat too? Schedule a time here.

Here’s what we have today:

Having “the talk” to increase AOV → Builders avoid talking about pricing with customers. Dont.

Steal from your favorite leaders → Borrow from the greats to incorporate into your own routine

Debt vs Equity Financing → VC funding is on the way down. Try debt financing instead.

Never miss a client call with this automation [members only] → Pissed off clients shrink your business. Read this to avoid that awkward convo.

Let’s jump in.

(P.S Have questions about scaling your business? Reply to this email or email me at [email protected])

Together With Attio

A CRM for the next era of companies.

If you’re a COO, you’ve probably had your CRM pop up in a few of your dreams nightmares.

(Trust me, I’ve been there.)

I spent hours trying to get our one-size-fits-all CRM to fit our company’s data and business model.

Then, I found Attio.

Designed with the new era of companies in mind, Attio is a radically new CRM with an emphasis on flexibility, efficiency, and revenue generation.

Attio easily configures to your company’s unique data structures and automatically enriches your contracts, so that you can spend less time troubleshooting data errors and more time driving real business growth.

Plus it lets you quickly build powerful custom automations to build better systems and accelerate every function of your go-to-market process.

Join companies like Modal, Replicate, and Eleven Labs using Attio to fuel their next phase of growth.

Operators Library

This CMO focuses only on this KPI for building a demand engine from scratch. (What KPI is that?)

The CEO of Pavillion (a community of over 10K GTM leaders) shares what he believes is the toughest challenge when transitioning from a startup to a scaleup. (Hint: communication can be painful)

This fractional COO dives into how a project manager can become a COO themselves (Here’s how she plans this career move)

This CEO with over 20 years old leading team talks about his 3 management non-negotiables (90% of issues can be tracked to these three)

Why creating a user manual can help remove yourself from the day-to-day grind (How to build your own user manual)

1. Having “the talk” to increase AOV

Insight from Kyle Poyar

I bet you were wondering why I reached out earlier this week about chatting

Talking to your audience is the best way to uncover insights.

Like me, have you ever considered tapping into your customers to fine-tune your pricing and bump up your Average Contract Value (ACV)?

It's a goldmine of insights. But here's the catch: don't straight-up ask them, "How much would you shell out?" You're bound to get answers that are on the low end.

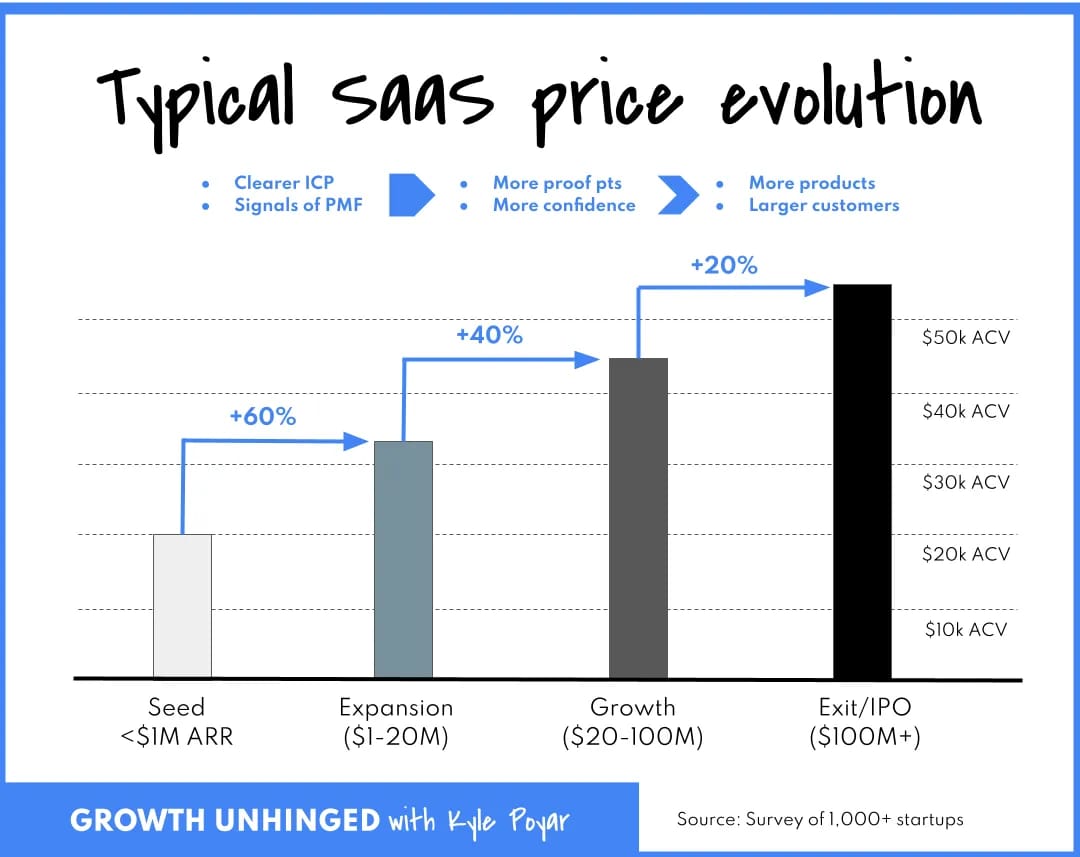

Kyle Poyar has noticed a pattern in the data from over a thousand SaaS startups. As companies scale from $1M to the stratosphere of $100M+ in Annual Recurring Revenue (ARR), ACV soars by 100% or more.

Here is the typical ACV Growth Journey of a SaaS Startup:

From Seed to Post-Product-Market Fit: ACV climbs by 60%

B2B customers aren't as price-shy as startups or individual consumers.

A solid product-market fit gives you a clearer picture of who your ideal customers are—those who see the value in what you're creating and are willing to pay a premium.

New customer cohorts won't bat an eye at price adjustments. For them, it's just the way things are.

When going from the Expansion to the Growth Phase, the ACV bumps up by 40%

You likely have untapped potential to capture more value from your offerings.

As evidence of your product's ROI piles up, and you get better at engaging with the decision-makers, you can refine your pricing strategy.

ACV growth now leans more towards smart packaging and usage-based models rather than straightforward price hikes.

Sure, the advice to chat with users to grasp their needs and pain points isn't groundbreaking.

Yet, a crucial piece often missing from these discussions is the willingness to pay.

You've got to ask the right questions to unearth those insights.

Some friendly advice before you dive in:

Don't label these chats as "pricing talks." Position them as general feedback sessions.

Engage with folks who have a say in the spending. In product-led growth (PLG) scenarios, your user might also be the buyer. In enterprise settings, it could be someone different.

Steer clear of leading questions. Keep them open-ended and neutral. Embrace the silence that might follow a question. It's all part of the process.

2.Steal from your favorite leaders

Insight from Rameel Sheikh

I didn't have a mentor while getting my start.

I don't know if that was because I am an introvert, the idea of networking felt gross, or didn't want to cause too many waves.

While I had remarkable managers, mentors offer a broader perspective that you can't get by yourself.

So my hesitation to ask for mentorship was a hurdle.

Instead of putting myself out there, I did something a bit weirder (but more effective!).

I "stole" the best practices from my peers and leaders to incorporate within my daily work.

While my manager was not always available for skill development, there's huge value in watching from colleagues.

Over time, I "stole":

Best practices on how to run an OKR meeting

How not to deal with a pissed-off employee threatening legal damages

How to gracefully communicate underperformance to a teammate

This approach isn't limited to the people in your company.

I recall when a well-organized follow-up email from a senior operations professional at another company caught my attention.

I still have it.

Here is an example of an email:

Not because there’s anything earth-shattering in there, but because I started using it as a template for strategy planning.

Learn More: Read why this works here

3. Debt vs Equity Financing

Insight from a16z

Debt financing can be a powerful tool in your arsenal. But it's crucial to understand how it differs from and complements equity.

First things first, debt is not a replacement for equity. Venture lenders use equity as a key validation point when underwriting startups, so founders often raise debt only after they've secured an equity round.

When considering debt financing, there are many tradeoffs to keep in mind. Let's say you're raising a $50M equity round at 10% dilution.

You could either increase the round to $60M at 12% dilution or raise a $10M debt facility to complement the $50M equity round.

In this scenario, you'd need to weigh the fees, interest, warrant dilution, and repayment terms of the $10M debt against the additional 2% dilution from the extra $10M in equity.

It's a delicate balance, but when done right, debt can offer more flexibility, less dilution, and faster access to capital compared to equity alone.

The key is to find the right mix of debt and equity based on your company's specific circumstances. As a general rule, the more debt you take on, the more accurate your predictions and plans for the capital need to be.

Otherwise, you risk losing out in the long run due to interest and fees.

When comparing debt and equity, there are several crucial factors to consider:

Priority: Debt lenders, instead of investors, have first dibs on your company's assets if things go south.

Cost of Capital/Dilution: Debt is non-permanent capital with costs from interest and one-time expenses. Equity is permanent ownership that reduces founders' stakes and shifts some decision-making power to investors.

Flexibility: Debt offers flexibility with financing options but may come with restrictive conditions

Timing: Raising corporate debt is usually quicker than equity (4-12 weeks vs. 2-3 months), though can take longer (3-6 months).

Covenants: Debt may include covenants that dictate certain conditions you must meet to stay in good standing with lenders.

Remember to consider the tradeoffs! Being on top of your obligations is a priority (while scaling your business).

4. How to use Zapier never to miss a client message

Insight from Jason Levin and Mike Cardona

Keeping track of all the client messages I get for my staffing agency felt like herding cats.

But then, I stumbled upon Jason's hack to automate his client communications. Steal this for yourself.

Here's how I used Zapier to create a seamless workflow that keeps me on top of client messages and tasks:

I set up Zaps for each Slack message, so when a client reaches out, I can simply hit "Push to Zapier."

The Slack message then zooms over to my Gmail account via Zapier. (You can send it directly to Superlist from Slack, but not if you're in 4 different Slacks like me).

From Gmail, the message forwards to my Superlist inbox, where it pops up as a shiny new task.

Within seconds of pushing to Zapier, the task appears in my Superlist Inbox. When I have a moment during the day, I drag the task to the appropriate list for that client.

With this automation in place, I can finally say goodbye to the chaos of missed tasks and forgotten follow-ups.

Learn More: 3 other automation tips to save 11+ hours a week

How Am I Doing? 👋

I love hearing from readers, and I’m always looking for feedback.

How am I doing with The Bottleneck? Is there anything you’d like to see more or less of? Which aspects of the newsletter do you enjoy the most?

Hit reply and say hello - I’d love to hear from you!

Cheers,

Rameel

Spread The Word

Share The Bottleneck with friends to get a few freebies. Maybe you’ll make some new ones on the way 😆

We’ll give you free stuff and more friends if you share a link. Only one link.

{{rp_personalized_text}}